BTC Price Prediction: Navigating Volatility Towards $90,000

#BTC

- Technical Hurdle at Moving Average: Bitcoin's price is currently testing resistance near its 20-day moving average (~$89,800). A clear break above this level is the first technical step needed to build momentum toward and beyond $90,000.

- Macro Sentiment is the Wildcard: Short-term price action is being dominated by traditional finance factors like U.S. inflation data and Federal Reserve policy jitters, which are currently injecting volatility and caution into the market.

- Strong Institutional Undercurrent: Beneath the price volatility, foundational support is building from public commitments by major firms like Fidelity and progressive legislation, which reinforce the long-term bullish thesis for Bitcoin.

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture

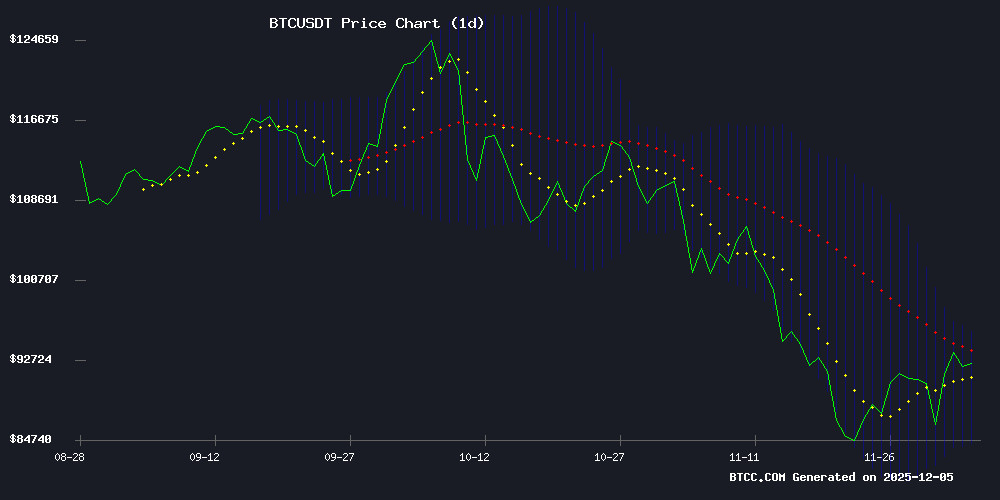

As of December 6, 2025, Bitcoin is trading at, slightly below the psychologically significant $90,000 level. The price is currently below its 20-day moving average (MA) of 89,801.67, indicating potential short-term resistance.

The MACD indicator shows a bearish crossover, with the MACD line (738.25) well below the signal line (4,187.26), resulting in a negative histogram of -3,449.00. This suggests weakening momentum.

Bitcoin is trading NEAR the middle band (89,801.67) of the Bollinger Bands. The upper band at 95,314.14 and lower band at 84,289.20 define the current volatility range. A sustained move above the 20-day MA could target the upper band, while failure to hold support may see a test of the lower band.

Market Sentiment: A Mix of Uncertainty and Institutional Confidence

Recent headlines paint a picture of a market grappling with macroeconomic crosscurrents and evolving institutional dynamics. Negative catalysts include Bitcoin's dip below $90,000, triggered by U.S. inflation data (PCE), ETF outflows, and warnings from the IMF about volatility. This has created a phase of broader market uncertainty and shifting sentiment.

However, these are counterbalanced by strong foundational signals. Fidelity CEO Abigail Johnson's reaffirmation of personal bitcoin holdings underscores long-term institutional confidence. Legislative progress, such as the push in Indiana to allow public Bitcoin investments, points to growing mainstream adoption. Furthermore, developments like Yield Basis's $1.6M BTC distribution and the emergence of new presale opportunities highlight continued innovation and capital flow within the crypto ecosystem.

Factors Influencing BTC’s Price

CryptoAppsy: A Smart Tool for Real-Time Cryptocurrency Tracking

The cryptocurrency market's relentless volatility demands tools that keep pace. CryptoAppsy emerges as a solution, offering real-time price tracking across thousands of digital assets—from Bitcoin ($91,237 mentioned) to emerging altcoins. The app aggregates global exchange data with 5-second refresh intervals, capturing arbitrage opportunities and sudden market movements.

Its unified dashboard consolidates portfolio tracking, personalized news feeds, and multi-currency support without requiring account creation. Available in Turkish, English, and Spanish, the lightweight mobile app features smart price alerts and instant notifications for newly listed coins. User reviews highlight its 5.0/5 rated experience, emphasizing efficiency gains over manual exchange monitoring.

BullZilla Emerges as Top Crypto Presale Opportunity Amid Bitcoin Nostalgia

The specter of Bitcoin's early days—when it traded for pennies—looms large over crypto investors today. Those who missed the chance to buy BTC at inception now face a familiar dilemma with BullZilla's presale, which has raised over $1 million and attracted 3,600 token holders. The project's stage-based pricing model mirrors Bitcoin's trajectory, offering what some see as a second chance at generational wealth.

BullZilla's current Stage 13 presale sells tokens at $0.00032572, with 32 billion already sold. The rapid uptake underscores growing retail interest in early-stage crypto projects, particularly those positioned as successors to Bitcoin's wealth-creation narrative. While no exchanges currently list the token, its presale performance suggests institutional attention may follow.

Yield Basis Activates $1.6M BTC Distribution for veYB Token Holders

Yield Basis, a Bitcoin liquidity protocol, has activated its Fee Switch mechanism, unlocking 17.55 BTC ($1.62 million) for distribution to veYB token holders. The move marks a pivotal shift in governance, redirecting accumulated admin fees from DAO contracts to a distributor contract tied to veYB stakes.

The protocol's fee structure splits revenue between liquidity providers and admin fees, with the latter now flowing to veYB holders proportional to their governance weight. This aligns incentives for long-term participation while enhancing liquidity across Bitcoin's ecosystem.

Since December 4, 2025, the Fee Switch has enabled automated distributions, creating a sustainable reward mechanism for stakeholders. The initiative reflects broader trends of DeFi protocols maturing their governance models to prioritize holder alignment over passive fee accumulation.

IMF Warning Triggers Bitcoin Volatility Amid Broader Market Uncertainty

Bitcoin's price whipsawed near the $90,000 level before retreating sharply as the International Monetary Fund issued fresh warnings about stablecoin risks. The selloff erased early-week optimism fueled by ETF launches, leaving traders questioning how deep the correction might run. Analyst Maartun notes consecutive 7% daily swings—a marked shift from January's calm—as the cryptocurrency flirts with a breakdown below $88,000.

Divergence from traditional markets persists. While equities stabilize amid easing US-China tensions and Netflix's landmark acquisition deal, Bitcoin continues its inverse correlation with stocks. The failure to hold key resistance levels exacerbates bearish sentiment, with on-chain activity suggesting heightened speculative positioning.

BTC Struggles Amid PCE Inflation Data, Market Sentiment Shifts

Bitcoin's price action remains subdued following the September PCE report, failing to capitalize on what appears to be stabilizing inflation metrics. The core PCE index—the Fed's preferred inflation gauge—has shown remarkable consistency over the past 24 months, challenging prevailing market narratives about runaway price pressures.

Consumer inflation expectations tell a contradictory story. While the Michigan survey printed at 53.5 versus 52 expected, the embedded 1-year inflation forecast dropped sharply to 4.1% from 4.5%. This divergence between present sentiment and forward-looking data creates tension for monetary policy makers.

The cryptocurrency market's muted reaction suggests traders are weighing two competing truths: macroeconomic stability versus the Fed's reluctance to pivot. With both 1-year and 5-year inflation expectations trending downward, the stage is set for renewed volatility across risk assets.

Fidelity CEO Abigail Johnson Affirms Personal Bitcoin Holdings and Long-Term Confidence

Fidelity Investments CEO Abigail Johnson has publicly reaffirmed her bullish stance on Bitcoin, revealing her personal ownership of the cryptocurrency during a keynote at the Founders Summit 2025. The financial executive positioned BTC as a enduring component of global savings portfolios, citing its institutional maturation.

Johnson's remarks underscore a growing trend of traditional finance leaders embracing digital assets. Her endorsement carries particular weight given Fidelity's $4.2 trillion in assets under management and its early institutional crypto custody services.

Expert Warns ETF Calm Is Temporary as Crypto Markets Mature

Nischal Shetty, co-founder of Shardeum, argues that Bitcoin ETFs have accelerated institutional adoption by providing a regulated gateway into crypto markets. The approval of spot Bitcoin ETFs has not only legitimized the asset class but also reduced operational hurdles for traditional finance players.

Bitcoin's recent price stability near all-time highs reflects growing institutional participation, according to Shetty. "Lower volatility around peaks signals institutional flows are dampening retail speculation cycles," he told Coinpedia. Steady ETF purchases have created more predictable demand patterns, smoothing extreme price movements.

This newfound stability remains fragile. Shetty cautions that macroeconomic shocks could reignite volatility, noting ETFs represent just one phase of crypto's maturation. The ecosystem still requires robust custody solutions, clearer regulations, and deeper liquidity to sustain institutional involvement.

Bitcoin Dips Below $90K as U.S. Inflation Data Sparks Market Volatility

Bitcoin's price tumbled below $90,000 following the delayed release of the U.S. Personal Consumption Expenditures (PCE) report, a key inflation metric closely watched by the Federal Reserve. The September PCE reading came in at 2.8%, matching expectations but showing a slight uptick from August's 2.7%. Core PCE also registered 2.8%, down from the previous 2.9%.

Market reaction was immediate, with altcoins suffering steeper losses of up to 7% as risk appetite waned. The sell-off reflects trader nervousness ahead of next week's Fed meeting, despite inflation remaining below the psychologically important 3% threshold since February 2025. Michigan consumer sentiment data added another layer to the economic picture as markets digest the implications for monetary policy.

Indiana Lawmakers Push Bill Allowing Public Investments in Bitcoin

Indiana lawmakers have introduced a proposal that would permit public funds across the state to invest in Bitcoin. House Bill 1042, filed in December, marks a significant step toward institutional adoption of digital assets in the U.S. Midwest.

The move reflects growing legislative confidence in cryptocurrency as a viable asset class for public treasuries. If passed, the bill could set a precedent for other states considering similar measures.

Bitcoin Tumbles Below $90,000 as ETF Outflows, Fed Jitters Rattle Crypto Markets

Bitcoin plunged below the $90,000 threshold during U.S. market hours, extending losses after yesterday's sharp ETF outflows. The selloff reflects mounting investor anxiety ahead of the Federal Reserve's December 10 policy decision, with traders bracing for heightened volatility.

No single catalyst triggered the drop, but market participants point to compounding pressures: institutional investors hedging Fed meeting risks, algorithmic traders amplifying downward momentum, and retail holders capitulating near key support levels. The $91,237 to $89,999 intraday range suggests bulls are losing control of the narrative.

While some analysts anticipated a dovish Fed pivot following weak employment data, crypto markets appear positioned for disappointment. Derivatives activity shows speculators increasingly betting on further downside, particularly if Powell maintains hawkish rhetoric. The coming hours may prove decisive for whether $90,000 becomes new resistance rather than support.

Bitcoin Tests Key Support Amid Resistance Struggle

Bitcoin faltered near the $93,000 resistance level, retreating to $91,237 and testing investor patience. The cryptocurrency's ability to hold above $84,000 offers temporary relief, but analysts warn that sustained momentum requires a decisive break above $97,000—the medium-term investor cost basis.

CryptoQuant data reveals BTC remains unstable below its realized price. 'Darfost' notes that reclaiming $97,000 could reignite bullish sentiment, transforming the level from resistance to support. However, 'DaanCrypto' emphasizes that mere spikes above this threshold won’t suffice; consistent daily closes are needed to prevent another sell-off cascade.

Will BTC Price Hit 90000?

Based on the current technical setup and market sentiment, a move to $90,000 is a pivotal near-term test but is certainly within reach. The price is currently less than 1% away from this level.

The path will likely be determined by the interplay of the following key factors summarized in the table below:

| Factor | Bullish Driver | Bearish Headwind | Net Effect on $90K Target |

|---|---|---|---|

| Technical | Price near middle BB; $90K is a close resistance. | Trading below 20-day MA; bearish MACD crossover. | Neutral to Slightly Negative. Needs to overcome MA resistance. |

| Macro/Sentiment | Strong institutional backing (e.g., Fidelity CEO). | Inflation data, ETF outflows, IMF warnings causing volatility. | Negative in short-term, creating hesitation. |

| On-Chain/Adoption | New investment bills, yield distributions fueling ecosystem. | Market appears to be in a 'risk-off' digestion phase. | Positive for medium-term support. |

"The $90,000 level is more than just a number; it's a key technical and psychological hurdle," explains BTCC financial analyst William. "Given its proximity, a breakout is possible on any positive catalyst. However, the bearish MACD and resistance at the moving average suggest it might not hold on the first attempt without a shift in momentum. The market needs to absorb the current macro uncertainty first."

In conclusion, while immediate volatility may cause dips, the confluence of institutional confidence and ongoing adoption provides a foundation for another assault on $90,000. A sustained break above could open the path toward the Bollinger Band upper limit near $95,300.